These 5 retirement conversations can help you prevent your clients from failing at retirement.

And these retirement conversations are needed now more than ever.

In an industry that’s being transformed by robo technology, non-traditional competitors, rising client expectations, mega-RIA firms, and free investment management from Charles Schwab, it’s no longer enough for financial advisors to help clients fund their retirement.

Today, financial advisors have to start finding and funding a fulfilling retirement. Getting paid to help clients generate a return on their investment is being mechanized away.

Instead of simply generating a return on investment, you can add tremendous value by helping your clients get a Return on Life.

My colleague Mitch Anthony and I have developed 5 retirement conversations that can help financial advisors prepare their clients for the reality of retirement, personalize their retirement, and integrate the financial retirement conversation with their life.

You can have these 5 retirement conversations with your clients whether they are a few years from retirement or already in retirement.

The 5 Retirement Conversations

1. Perceptions

What have your clients observed about people they know who are currently retired? What have they identified as some traits of happy retirees? What about unhappy retirees? Advisors can also supplement this discussion with their own experiences with clients who have made both successful, and maybe not-so successful transitions into retirement.

2. Direction

Research shows that people who are retiring TO something are more successful in retirement than people who are just retiring FROM something. Help point your clients in the right direction, whether that means moving to a vacation destination, taking on part-time or volunteer work, or a calendar full of tee times.

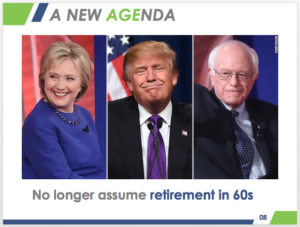

Hillary 69, Donald 70, and Bernie 75. When most people are retired, these three fought to win the most stressful job in the world.

3. Work

Traditionally, when a person retires, he or she doesn’t work anymore. For both social and economic reasons, that’s no longer true of all retirees. Do your clients want to keep working? Do they want to take a part-time job to keep active? Or maybe turn a lifelong hobby into a dream side business? Do they have to keep working in order to make ends meet?

4. Agreement

Often couples struggle in retirement because each person has a very different idea of what retirement is going to look like. Maybe one person envisions non-stop globe-trotting, and the other just wants to string up a hammock in the backyard. As an advisor, you can help facilitate this conversation to make sure that both people experience happiness and fulfillment in retirement.

5. Money

Clients often ask, “Do I have enough money to retire?” That can be answered with software and is easily mechanized away. By contrast, if you want to remain relevant as a financial advisor for years to come, you can add greater value in your client’s life by helping them “get the best life possible with the money they have.” Again, integrating financial conversations with lifestyle conversations provides a value to clients that robo advisors and the internet can’t match.

These five retirement conversations won’t just lead to better retirements for clients, they’ll also help financial advisors add value to their business, close the 70 bps gap, differentiate from the competition, and create meaningful, sustainable relationships with clients.

In our Retirement Coaching Program, Mitch Anthony and I go into great detail on each of these conversations and provide you with a specific tool you can use to facilitate these conversations.

Click here to learn how you, as a financial advisor, can become a Retirement Coach to your clients. You’ll gain access to our Return on Life retirement coaching philosophy, and see how our 5 Retirement Conversation Tools can help kickstart these conversations and transform your business.