Getting retirement planning for couples right takes work.

Like most major life transitions, there are surprises, disappointments, and unexpected detours. If not planned for, spousal relationships, in particular, can be put to the test. In my work with financial advisors, I’ve heard stories of clients ending up divorced after just a year of retirement.

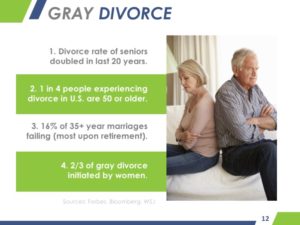

In this article, we’ll explore what can go wrong, and why financial advisors should care. But first, let’s take a look at a few statistics from a National Center for Family & Marriage Research study (“The Gray Divorce Revolution”):

In this article, we’ll explore what can go wrong, and why financial advisors should care. But first, let’s take a look at a few statistics from a National Center for Family & Marriage Research study (“The Gray Divorce Revolution”):

- Divorce rates for seniors have doubled over two decades (1990-2010).

- One in four people going through a divorce is at least 50 years old.

- The rate among women has tripled (from 4 percent to 12 percent).

As we’ve been discussing over the last two months, there’s more to retirement planning than figuring out a client’s “number.” This is especially true for retirement planning for couples. A successful retirement takes work (the double entendre is deliberate—more on this later; plus, see last month’s article). Couples you advise may not share the same vision of what an ideal retirement looks like. The fact of the matter is that retirement is an experiment in activity, relationship, and time, and may take several tries to achieve the right balance.

Here’s where financial advisors come in. One to three years before retirement, start a retirement planning for couples conversation with your couple clients about how they each envision their retirement. I’m not suggesting you become a marriage counselor, but if your clients are not in sync with each other, this discrepancy could impact their financial assets. Imagine if one spouse wants to travel, and one wants to continue working part-time—those decisions impact how much they need, and when they can transition. There’s a potential economic impact for your clients (and as a result, for you).

Let’s revisit those stats above regarding divorce. If your clients end up divorcing, the economic impact on them could be any of the following: retirement funds are split (and not necessarily 50/50); alimony for someone is probably a given, and women are generally hit harder. The impact to you is a loss of assets because you will probably lose at least one client—not to mention the emotional impact of having long-time clients split up.

In our retirement coaching sessions, Steve Sanduski and I discuss how we’ve observed that men are more likely to go from all work to all play—women tend to know how to balance work and life more effectively. Of course, this is a general statement, and isn’t true for all men or all women. However, in my conversations with financial advisors and their clients, I’ve found that men are more likely to feel aimless: without an office to go to, they find they have no purpose. They need to have some engagement beyond their “to-do” list. Invariably, one spouse ends up micromanaging, becoming increasingly disgruntled, and failing to give their partner the space he or she needs. I don’t know about you, but that doesn’t sound like a very fulfilling retirement to me.

Putting Retirement Into Perspective

Without getting all “Dr. Phil” on your clients, you can bring a new perspective to the retirement conversation by helping your clients broaden their perceptions:

Perspective #1: A successful retirement takes “work.”

You can’t wing retirement, and hope you’ll “keep busy.” That simply doesn’t work. Retirement planning takes a lot of work and even more dialogue. Financial advisors are in the perfect position to facilitate those conversations. Here are three questions to get the ball rolling:

- Do you have enough?

- Have you had enough?

- Will you have enough to do?

Most financial advisors only address, “Do you have enough?” That’s a huge mistake, and a missed opportunity to make yourself stand out. As I mentioned above, the double entendre is intentional: a successful retirement does indeed take “work.” Your clients need to take into account the emotional and economic impact of continuing to work. For example, as many of you know, I travel a great deal. Many of the limo drivers who pick me up at the airport are retirees. From my conversations, I discovered that they really didn’t want to quit working, they just didn’t want to face the same daily grind.

Be sure your clients’ expectations are realistic, and be sure they understand how their goals can impact them financially. One spouse may want to continue working part-time, while the other spouse never wants to work again. These two different goals will clash at some point.

Perspective #2: Spouses may not share the same retirement vision.

Building off perspective #1, couples don’t always want the same thing. One spouse may envision traveling around the world, while the other spouse wants nothing more than to be a homebody after traveling for business over the past several decades. As noted above, one spouse may be interested in working, while another wants to go back to school. Knowing what each spouse envisions can help you and your clients plan accordingly so they have enough money to enjoy both individual and mutual pursuits.

Perspective #3: Retirement is an experiment in activity, relationship, and time.

Clients need to know that they may go down one path that doesn’t lead anywhere, and then choose to follow another one. That’s okay. Clients need to know they may not get retirement right the first time. Your clients may end up cycling in and out of work—and that’s okay too. Let clients know what to expect, so you can help them prepare financially. Help your clients understand how non-financial decisions impact their portfolios, and why it’s important to have this discussion sooner, rather than later.

Retirement used to be about jumping off a cliff (requiring a parachute to ensure a safe landing), but The New Retirementality is about experimenting until you find a balance that works for both spouses.

Be sure any dialogue with your clients includes the following:

- Leisure (i.e., “How much do you want to travel?”)

- Connection (i.e., “How much time do you anticipate spending with family/friends?”)

- Personal Renewal (i.e., “What physical/mental/spiritual well-being activities do you want to engage in?”)

- Work (i.e., “What role will work have going forward?”)

Bringing this type of organization to conversations with your clients not only adds value to the relationship, but also helps you ensure your clients have the funds to achieve their goals. In addition to gathering and analyzing the numbers, you need to hear your clients’ stories. Without their stories, it is impossible to put together a realistic financial plan for retirement.

Couples probably don’t get the chance to discuss their visions for retirement as often as they should, and then compare those visions as a couple. Here’s a simple exercise: Have your clients list their goals individually, and then compare their answers. Limit the number of answers, so the list doesn’t get unwieldy (I recommend between six to ten goals). You and your clients may be surprised at how far apart they are in some areas. If you see, for example, that one client wants to continue working, while another does not, this disparity can have an impact on how much they need to save (or not save). Regardless, it certainly indicates that they aren’t on the same page. My advice would be to first focus on areas where clients have the same, or similar, goals. If they both list traveling as one of their goals, have a dialogue about how often, so you can plan for that.

By asking the right questions, raising awareness, and encouraging your clients to continue the conversation once they leave your office, you’ll set yourself apart from other financial advisors who simply crunch numbers. Be sure to always bring the conversation back to the economic impact of retirement goals, and remind clients that your role isn’t to help them make the decisions (and it’s certainly not to be a marriage counselor)—it’s to ensure that they have the financial resources to make those decisions happen.

The hard part of retirement planning isn’t figuring out how much your clients will need—it’s everything else.

© 2017 Mitch Anthony

Mitch Anthony is the founder and president of Advisor Insights Inc. and the Financial Life Planning Institute, the leading provider of financial life planning tools and programs for the financial services industry.

For almost two decades, Mitch and his team have provided training and development for both individual advisors and major organizations throughout the world. Mitch personally consults with many of the largest and most-recognizable names in the financial services industry on both financial life planning and relationship development.

Mitch is a consistently top-rated presenter who has spoken to groups ranging from 10 to more than 10,000. He has been named one of the financial services industry’s top “Movers & Shakers” for his pioneering work. Through the Institute, he has partnered with Texas Tech University, the University of Georgia, and Utah Valley University to develop financial life planning programs for their undergraduate programs.

Mitch is a sought-after expert for the media, and a regular columnist for Financial Advisor magazine. His columns have appeared on CBS MarketWatch and in the Journal of Financial Planning. His original comic strip “Stanley Brambles, CFG (Certified Financial Guru)” has appeared monthly in the print edition of Research magazine. Mitch is also host of the daily radio feature, The Daily Dose, heard on over 100 radio stations nationwide.

Mitch is also the author of many groundbreaking books for advisors and consumers, including perennial bestseller StorySelling for Financial Advisors, cited by “Financial Advisor” magazine as the number one “must-read” book for financial professionals. Mitch’s other books include The New Retirementality (now in its 4th edition), From the Boiler Room to the Living Room, Your Clients for Life, Your Client’s Story, and The Financial Lit-Kit: The Cash in the Hat, The Bean is Not Green, and Where Did the Money Go?. For information on these books and more resources, click here. Contact Mitch at mitch@mitchanthony.com.